[ad_1]

POSTED ON: 07/26/22

From trend spotting and retail pop-up, to developing in-store marketing strategies to help navigate ongoing business challenges, we’ve collected some of our ‘Best Of’ retail blog posts for your perusal and enjoyment. Packed with insights and observations, we’re sure you’ll find more than a few ideas and approaches that will make you think differently about your business and the opportunities that lie ahead.

New Year – New Trends: 3 Trends to Watch in 2022

Each year we like to kick off the new year by focusing in on up-and-coming trends that we think show promise of further adaptation and growth in the year ahead. And one of the best sources of trend tracking (other than our constant and limitless curiosity on such things) is an annual list of trends compiled by Trend Hunter in their annual Trend Report.

The report is a lengthy and robust one. In fact, in this year’s report – we kind of lost count after 125 trends. And something I often struggle with is that the list is hard to whittle down. But as my team is constantly reminding me, less is more, so keep it pithy but be sure not to leave out all the good parts. Then they leave me to write. Which can be dangerous. Especially when talking about trends.

Anyway – with that said, and trying to keep a diligent eye on my word counter, we have identified three trends that we strongly feel will continue to gain momentum in this new year and beyond. And to back up our picks, we’ve provided some real-time examples that showcase each trend, providing insights and examples that will have you agreeing that these are worth keeping an eye on.

Our picks for 2022 land in these three areas:

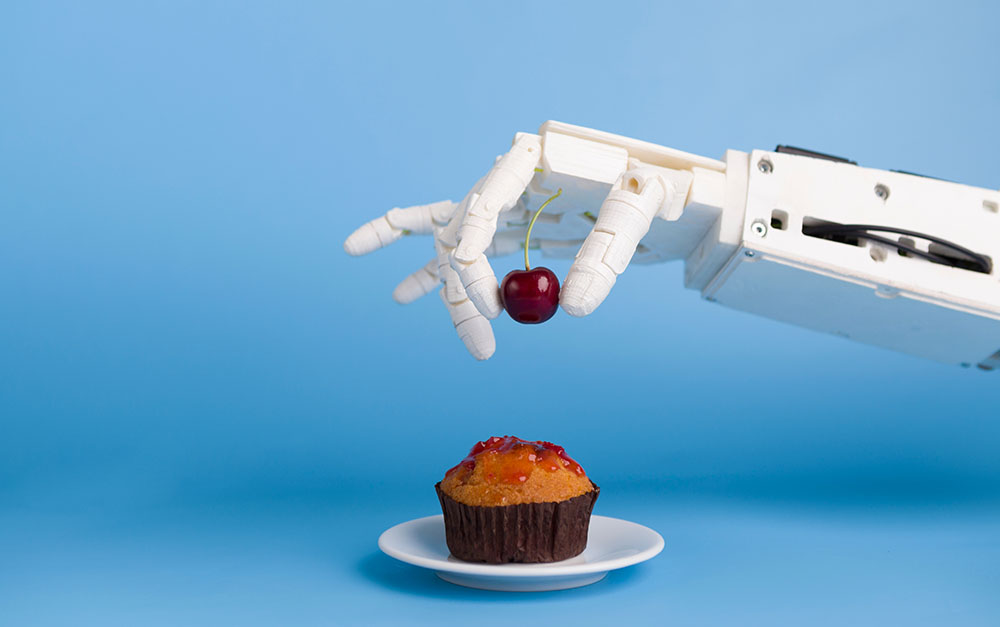

- Robot Retail

- Shoppable Experience

- Virtual Labs

Trend #1: Robot Retail

The idea of robots providing services to humans is not new. Although the idea conjures up visions of Rosie, the Jetsons’ housekeeper, skirting around their Orbit City home, chasing Astro’s crumbs, robots have long been used to support everything from manufacturing and medical procedures to warehousing fulfillment and law enforcement.

But with the advent of AI and other technological advancements, their use has found other channels that had previously not been explored as they would’ve been an extravagance. And a costly one at that.

Enter 2020, and all things changed. Rosie Part Deux.

Not limited to the iRobot (the new Rosie) that navigates its way through your home, robots have found their way into our everyday lives. In services and in ways that we could have never imagined, much less thought we would now need.

In a 2020 article from Forbes.com, a report by ABI Research states that “by 2025, more than 150,000 mobile robots will be deployed in bricks and mortar establishments.” And this estimate was even before the pandemic had put the need of store cleanliness at the top of the must-have list. According to zdnet.com, a survey conducted by RetailWire and Brain Corp, “One of the big drivers of adoption during the pandemic has been the hyper focus on cleanliness. Stores have ramped up cleaning protocols, but the end of the pandemic will leave lasting expectations. According to the survey, the vast majority (72%) of respondents say they do not anticipate much change in consumer expectations toward in-store cleanliness even after vaccines are broadly distributed.”

So, robots have found their way into mainstream retail, mostly for mundane, non-revenue producing things like cleaning and inventory audits, etc. Okay – all good. Especially the cleaning part because that will now be an expectation by all customers – for all obvious reasons. But what now?

Well, what happened towards the end of 2021 really answered that question.

While some retailers and grocers had already begun to recognize the value added in terms of operational labor and payroll costs, the truly unexpected drop in the labor force and its measurable impact on the selling floor served to accelerate need. No more just the task masters, robots are now replacing sales associates out on the selling floor. And providing the support and yes, selling capabilities that suddenly and dramatically are now absent in store due to labor shortages.

In a recent interview with Retail TouchPoints, Suzanne Larabie (VP Portfolio Leader – Consumer Products Retail Distribution, West Coast Region at Capgemini) noted that while self-serve kiosks can help shoppers easily access product information, properly implemented robots can bring the convenience to the next level by actually guiding shoppers rather than just telling them where to look. If an associate is busy with another task, a dedicated machine can always be on hand to help and possibly save a sale.

When was the last time a salesperson actually walked you to the product you were looking for, down the aisle and to the exact shelf?

While robots may not completely replace humans in store, their need certainly has grown, even in a few short months. And it doesn’t look like it’s going to change anytime soon. Read More

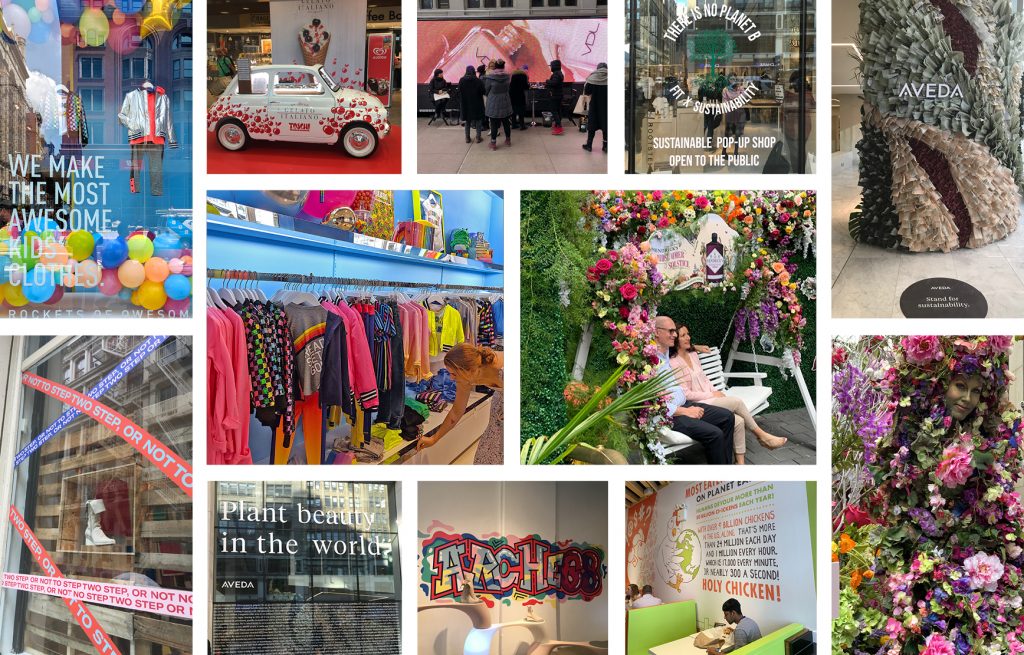

The On-Going Evolution and Value of Pop-Up Retail: 6 Questions to ask if it’s right for you

In 2008, the retail world, at least in the U.S., faced multiple challenges and on many fronts. As online buying began to grow in step with shoppers’ comfort with this channel, the pull of foot traffic from brick-and-mortar stores to the online experience was felt progressively by many retailers almost daily.

Adding to this, the economy at large was doing a nosedive and those retailers who were tethered to expensive operations and real estate began to pull back, with many closing down completely.

As this happened, storefronts became empty and it seemed overnight that main-street retail saw a sea of “For Lease” signs quickly replacing window displays, even in the most urban and populated areas of the country. As a result, many landlords found themselves in a desperate effort to find tenants to fill, if not just temporarily, their empty properties. Providing even a short-term revenue stream in place of what typically was a 3-, 5- or even 10-year lease agreement.

This was truly the birth of pop-up retail. It filled an immediate need and addressed rather dire economic circumstances on both sides. A win-win for many. Landlords got a check and the promise of a rotating schedule of new tenants coming in and retailers, along with smaller brands, could set up shop on much more palatable (and inexpensive) terms. What I’m saying here is that for the price of one digital advertisement, many were now presented with the ability to open up an actual shop for a few hours, days, weeks or months, securing sales while also scouting out a potential longer-term stay. What’s not to like about that?

What’s that saying?…“Necessity is the mother of invention”?

What started out as a remedy for abandoned storefronts would over time evolve into something much more than what its humble beginnings even gave a hint to. And as we looked on with great interest, we watched as the pop-up retail concept morphed into many different ideations, missions, uses and approaches. We watched how pop-up retail became an added marketing channel and saw the endless variety of consumer experiences it could provide for not only big names with deep pockets, but also for smaller start-up players. And to date there appears to be no end to its virtues, especially now, when so many find themselves still trying to navigate through an on and off post-pandemic uncertainty. While shoppers might still be hesitant to patronize large retailers, they remain hungry to have an in-person, tactile experience and pop-up retail continues to offer this in ever-changing and imaginative ways.

“Cha-cha-cha changes!”

As mentioned, what began in 2008 out of economic need has, over the last 13 years, evolved into a whole new approach in retail marketing and exposure. While the Halloween seasonal pop-ups continue to flourish and take over empty mall spaces and closed Sears stores, pop-up has now entered a realm made for much deeper and meaningful connections with consumers.

We wrote extensively on pop-up’s ability to serve many needs and many aspirations, but the one thing that we had predicted that has proven to be true is that retail pop-ups are a non-passive approach in connecting with consumers; taking brands and retailers directly to the shopper in ways and into communities that no one single store could ever hope to achieve. Pop-up retail was and is the springboard of experiential retail—executable and realistic even for those new to the game.

Through 2017 on into early 2020, retail pop-up was on a mega ride, fanning out to consumers in activations that were as unique as they were engaging. We wrote about some of these experiences that included brands like Hendricks Gin, Timberland and Casper and marveled at the depth of imagination that some of these entities took in giving shoppers a memorable and brand-bonding experience.

And then came the pandemic.

Quickly, consumers now in lockdown mode and limited in their physical shopping ran to online resources to get their immediate and staple needs addressed. If there’s a choice between a new pair of shoes and running out of toilet paper, the later will always win out. So, for a while, basic needs were the main focus.

But once initial supply chain issues were addressed and pantries began to fill up with all of those necessities, consumers took a breath. And while still in lockdown mode, they turned to online shopping as sort of a venue for entertainment, filling their long hours and days at home with some sort of diversity. Maybe not so much in the shopping experience, but certainly in terms of the new and relatively unknown product offerings they began to become exposed to online and through social media.

So many of the brands showing up on their news feeds and social media pages became the new rising stars. Expressing the attributes of their products in ways they never could sitting on a shelf in Target (even if they made the cut). Using fun videos, influencer demos and fan-generated content, these lesser-known e-commerce brands got consumers attention. And they had a captured audience who still wanted to shop, but preferred to do so in the safety of their own homes.

What big-box couldn’t provide, the online experience delivered. New brands. New products. And the exposure that many of these smaller e-commerce entities experienced quickly elevated them into mainstream retail—without ever needing to touch an in-store shelf. As a result, and not surprisingly, their sales took off.

Brands like Thrive, Ruggable, Wetonic and Vegamour, to name just a few, gained incredible momentum in exposure to shoppers through the sometimes seven or more hours a day spent online while at work and/or at home. And because of this, these brands, along with many others who had never been on store shelves, now became the “faves” of pandemic-weary shoppers.

As shoppers now return to physical retail, their lust for new, independent brands will not fade. To the contrary, that desire to explore, interact with and shop non-legacy brands will grow even stronger. Read More

New In-Store Challenges: How labor shortages and supply chain issues require different thinking in store

A great start

It seems like such a short while ago when we were beginning to see the light of day on this pandemic-challenged economy. Shops reopening, retailers and other businesses optimistic that consumers would soon return with enthusiasm to their physical environments, quickly picking up where they had left off. After over a year of consumers being continuously tethered to the digital, at-home experience, many on both sides were hopeful that perhaps and thank goodness at long last, they/we were on the pathway to some sort of normalcy in the marketplace.

Unfortunately, that joyful optimism would be short-lived.

And now this…

Just when we thought it was safe to go back in store (which it was and still is) and get back to business, a whole new series of challenges confronted us. None more debilitating to any industry trying to just get back on its feet, this one cut many off at the knees—labor shortages at levels beyond which we have not experienced in recent memory.

Many news reports claim that there 10 million jobs presently open in the United States, even though there remain 8.4 million people unemployed. And while one might think this is pandemic caused, not all of it is related.

In a supplychainbrain.com article entitled: Why the U.S. Labor Shortage Isn’t Going Away Anytime Soon, the author writes “The Covid-19 pandemic didn’t cause the labor shortage, but it certainly amplified the tightened labor market and accelerated the future state of work, particularly for blue-collar workers. Other factors that contribute to labor challenges include the increase in e-commerce, demographic shifts, evolution of the gig economy, lack of access to and high cost of childcare, and pandemic relief and unemployment benefits.”

This might last a while.

So, while yes, some of what’s happening here could be linked to Covid, there are many other factors at play. And we might very well be witnessing a cultural shift in the choices of those who typically fill blue-collar roles in retail. “While a lot has been written about the overall tightness of the labor market, much less has been written about severe labor shortages of blue-collar and manual services workers—the exact opposite of the trends in recent decades,” Gad Levanon, vice president of labor markets at The Conference Board, told FOX Business.

And as you can imagine, the impact to physical retail has been palatable. From stocking shelves to checkout, retailers are struggling to keep store operations going. And many are turning to automation, robotics, high tech to address the growing lack of human hands to manage.

But what about consumers who need help in store? Even before all of these challenges, helping shoppers in store with their questions, or providing important information to support and drive purchasing, finding in-store staff to help was like playing a game of “Where’s Waldo?”. If you could find someone to ask a question of, they didn’t work in that department. If you were lucky enough to find someone who worked in the department you were in, then likely you had three patrons ahead of you with questions (probably even more complicated than yours).

Personal one-on-one interactions with store staff have for years been a problem. With many retailers seeking to manage store operational budgets and payroll being the number one most controllable expense—floor staff were multi-tasked to support a myriad of tasks—customer service wasn’t one of them.

Now, with the challenges of trying to find labor period, the shopper has truly been abandoned to their finding their own way in store or saying screw it, I’ll just go on Amazon and I can get all my questions answered and I won’t need to leave the comfort of my home.

But….I want to leave my home. I want to go to the store. I need to get out! Isn’t there some way to have my questions answered while experiencing new products? Isn’t there a way that I can be entertained, inspired, and helped all at the same time while I’m physically in store?

In June of 2020, we wrote about how in-store signage and display was more important than ever before. But at the time, the focus was mainly on the reentry into physical retail and the value of welcoming back shoppers, surprising them, while also helping to perhaps reacclimate them to a changed in-store experience.

Little did we know that the value of in-store signage and display would once again reign as your best silent salesperson now, maybe the only “salesperson” out on the floor.

How do I count the ways?

In our June 2020 blog—5 Reasons In-Store Signage Is More Important Than Ever, we listed these 5 reasons:

- Help the Shopper Find What They’re Looking for But Also What They Didn’t Know They Needed.

- Demonstrate What Packaging Doesn’t

- Promote Both in Store and Online

- Quickly Pivot Your Offerings

- Surprise. Delight. Entertain. Reward.

None of the five reasons that we sited about in-store signage in 2020 have really changed. They are all still relevant, but now maybe even more so.

As staff shortages leave shoppers completely on their own in store and supply chain problems have retailers scrambling to quickly pivot and redirect shoppers to substitute products, each one of these five reasons now take on new meaning, and certainly new interpretations. Read More

[ad_2]

Source link

Related posts

Today's pick

Recent Posts

- Cultural Evolution of Hot Yoga: From Bikram’s Legacy to Modern Studio Innovations March 29, 2025

- The Future of Automotive: Innovations Shaping the Industry January 23, 2025

- The Benefits Of Online Therapy: Convenient And Effective Counseling At Your Fingertips June 1, 2024

- Seminary Schools In Texas: Nurturing Faith And Knowledge In The Lone Star State June 1, 2024

- A Definitive Guide To Understanding Business Personal Property Tax June 1, 2024